Debt Relief ~ The Only Way Out, Even When in Overwhelming Debt!!!

When you are not able to manage your medical bills, credit cards, payday loans or other bills, only a debt relief program can help you. There are numerous options debt consolidation, debt settlement and debt management. To determine what suits you best, you can opt for a no-obligation counseling, that’s free of charge. This will give you an idea on how to proceed. Here’s a look at the top few debt relief options:

Five Different Debt Relief Options and How to Determine what’s Best:

Listed below are five emergency debt relief options. A brief outline will help you understand each option and makes it easy for determining what’s best.

Consolidation programs: If you are a person intending to minimize interest rates and make just one payment against loan, then debt consolidation will be your best bet. There are many Debt Relief companies that offer such programs. Here’s a list of the benefits when going with a debt consolidation company, besides they negotiating on your behalf:

- Reduction in Interest Rates

- Reduced Monthly Installments

- Reduction / Waiver on the Late Fees

- One Monthly Payment

- Absolutely no calls harassing for repayment from different creditors.

Debt Consolidation payment is chosen, for solving two purposes:

Credit card consolidation: When you are not able to manage different credit cards and make individual payments for each, credit card consolidation can be ideal. Opting for credit card debt relief programs, it is possible to consolidate different credit cards into one payment towards repayment, every month. You can choose a debt relief USA company to get this done for you.

Bill consolidation: If pending bills on medicines or utility is your problem, then choosing bill consolidation will help with handling the same. It could be any bill, including credit cards, store cards or even personal loans. You could include it to debt relief plans or programs.

Debt settlement: This is another option where you hire a settlement company to negotiate you’re your creditors and reduce the outstanding debt. Settlement is just one way to get credit card debt relief and more useful when you have multiple card and can’t manage minimum monthly installments.

The advantages of choosing Debt Settlement include:

- One monthly Payment

- Avert lawsuits / wage garnishment

- Single monthly payment

- Harassing calls from creditors will come to a stop

- Avert Bankruptcy filing

Debt management: This is another debt relief USA program, for which your debt will be analyzed by a credit counseling agency, along with your financial situation. Based on this, they negotiate with your creditors, to help you with promptly paying off bills. When opting for this method, you don’t send your repayment to creditors, but rather, send them to the credit counselor. This is then distributed amongst your creditors.

Advantages of Debt management:

- Reduction in Monthly Interest

- Reduced Monthly Installment

- Waiver on late / extra charges

- Creditor / collection calls will be curbed

Self repayment plan: This is an option where you get to manage your own funds, without help from professional debt relief USA programs. In this method, you come up with a list of expenses, debts and other priorities and then, prepare a budget according to which, you can pay all your bills and manage the funds, wisely.

Advantages of self-repayment:

- Pay off your bills without professional help

- No obligation to pay for the services of a third party

- You learn to better manage your money and expenses

Bankruptcy: You can choose between Chapter 7 & 13, to file a Bankruptcy when other debt relief programs don’t help you get out of debt. In such a scenario, Bankruptcy gets you relief through the court and is your last and only hope! However, this also ruins all your credit history and it is really difficult to qualify for loans post Bankruptcy. It is ideal to forget Bankruptcy and try other debt relief USA programs.

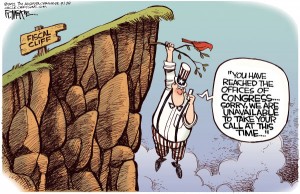

With only four days left before the “fiscal cliff” hits, Congress, President Obama, the Republican and Democratic leaders are all rushing to come to a solution for 2013 budget deficit. The “fiscal cliff”, in a nut shell, is a term used to describe the economic effects that will occur if existing laws remain unchanged regarding taxes and government spending. One group suggest higher taxes and more temporary economic stimulus spending while the other group propose to extend all of the Bush tax cuts which they claim will help fuel business growth and consumer spending as well as cut the expansion of Medicare, Medicaid and Social Security in order to curtail the deficit over time and speed economic recovery. If no deal is reached by December 31st, economists assert that the financial markets will collapse and the U.S. will go into a recession. How will this impact our lives?

With only four days left before the “fiscal cliff” hits, Congress, President Obama, the Republican and Democratic leaders are all rushing to come to a solution for 2013 budget deficit. The “fiscal cliff”, in a nut shell, is a term used to describe the economic effects that will occur if existing laws remain unchanged regarding taxes and government spending. One group suggest higher taxes and more temporary economic stimulus spending while the other group propose to extend all of the Bush tax cuts which they claim will help fuel business growth and consumer spending as well as cut the expansion of Medicare, Medicaid and Social Security in order to curtail the deficit over time and speed economic recovery. If no deal is reached by December 31st, economists assert that the financial markets will collapse and the U.S. will go into a recession. How will this impact our lives?